Hear what our clients say about using Quick Collect’s secure money transfer app and seamless cross-border payment system.

Canada

Canada

Nigeria

Nigeria

Ghana

Ghana

Kenya

Kenya

Uganda

Uganda

South Africa

South Africa

Zambia

Zambia

Canada

Canada

Nigeria

Nigeria

Ghana

Ghana

Kenya

Kenya

Uganda

Uganda

South Africa

South Africa

Zambia

Zambia

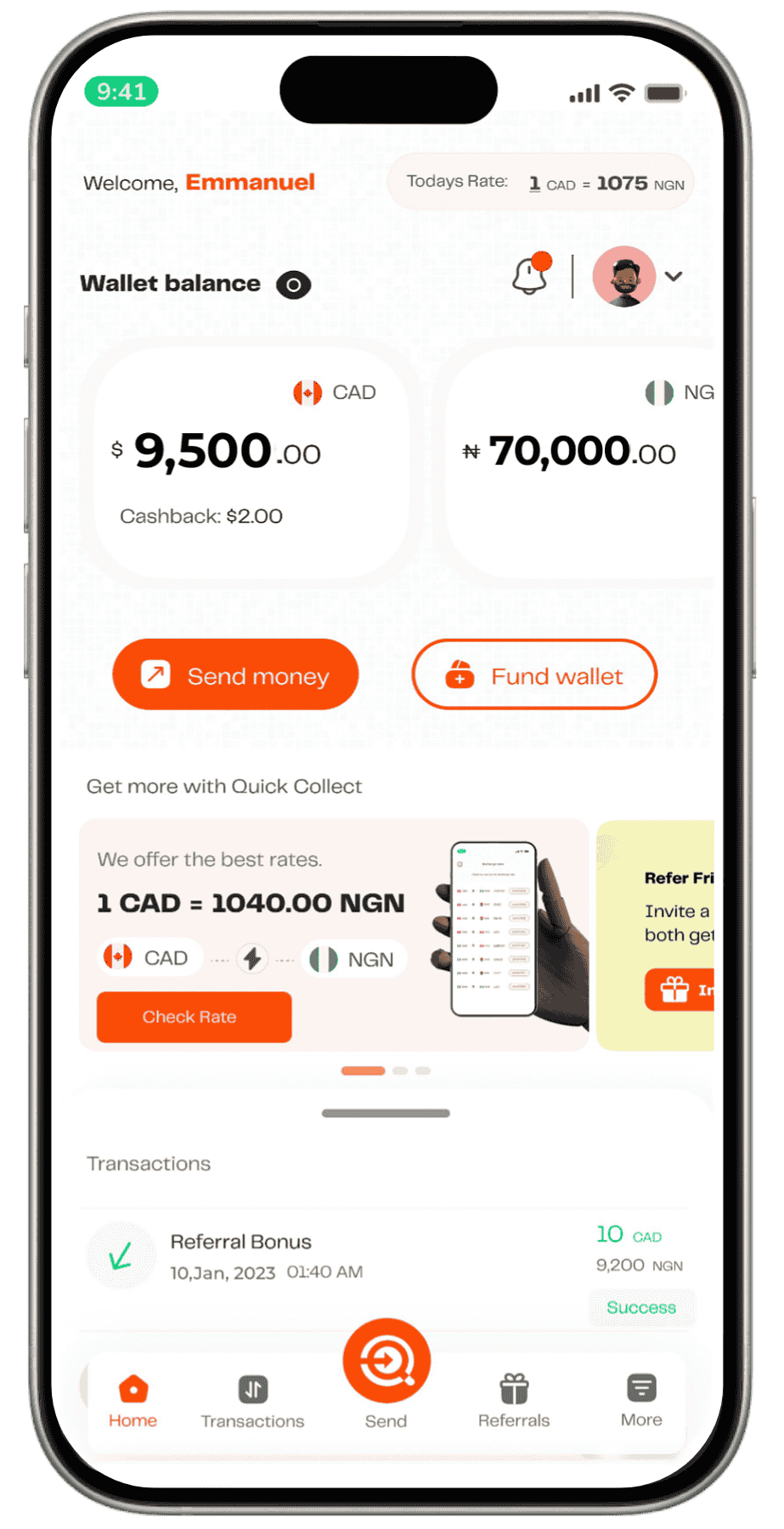

Quickly send money from Canada to Nigeria, Ghana, Kenya & Uganda fast and free of hidden charges

We’re FINTRAC registered and use top-level encryption.

Earn Cashback anytime you send CAD to NGN. With your referral code, you will earn $10 anytime

Quick Collect features a simple, mobile-friendly interface that makes sending money easy even for first-time users, with a focus on security and convenience.

Hear what our clients say about using Quick Collect’s secure money transfer app and seamless cross-border payment system.

Trustindex verifies that the original source of the review is Google. Amazing costumes serviceTrustindex verifies that the original source of the review is Google. Blessing was a timely blessing. With patience , good manners and clarity, she was able resolve my issues with ease. I am grateful!Trustindex verifies that the original source of the review is Google. Quick Collect has truly streamlined my payment processes! The app is incredibly efficient, allowing me to send and receive money in just a few taps. I love how intuitive it is, making my financial management so much easier. Fantastic service!Trustindex verifies that the original source of the review is Google. Best exchange company.very reliable and beat exchange rateTrustindex verifies that the original source of the review is Google. I've been using this money transfer app for months, and it has never let me down! The transactions are quick, and the security measures give me peace of mind. Five stars!Trustindex verifies that the original source of the review is Google. Highly reliable! I’ve used Quick Collect multiple times, and it never disappoints. Super convenient and efficient.Trustindex verifies that the original source of the review is Google. Quick Collect makes sending and receiving money so easy and hassle-free. Transfers are fast, secure, and the app is very user-friendly. I highly recommend it for anyone looking for a trustworthy money transfer service!Load moreVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Create your account with email or phone

Type amount, recipient’s bank info

Money arrives fast with real-time notifications

Secure, fast and free, revolutionize the way you handle transactions online.

Settle your utility bills with ease.

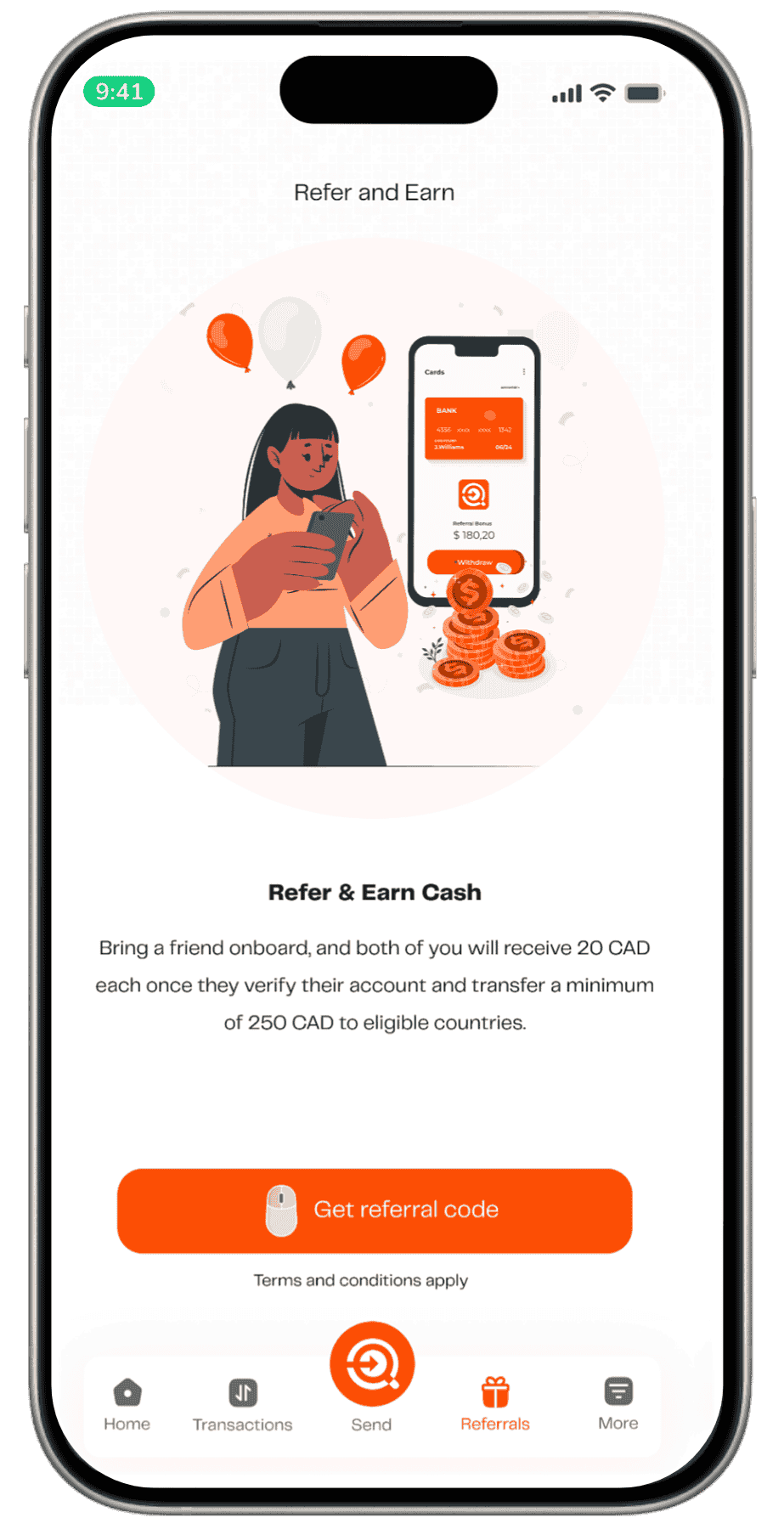

Refer a friend to send money with quick collect app and earn $10 CAD

Transfer Up to $60,000 CAD in a month

When you send ($ CAD) | Recipient receives (₦) |

1 CAD | 1,160 NGN |

5 CAD | 5,800 NGN |

10 CAD | 11,600 NGN |

20 CAD | 23,200 NGN |

30 CAD | 34,800 NGN |

50 CAD | 46,400 NGN |

When you send ($ CAD) | Recipient receives (₦) |

50 CAD | 58,000 NGN |

100 CAD | 116,000 NGN |

150 CAD | 174,000 NGN |

200 CAD | 232,000 NGN |

300 CAD | 348,000 NGN |

400 CAD | 464,000 NGN |

If you’re looking for speed, zero fees, and a no-stress process, Quick Collect is your best bet. The app is designed to make sending money from Canada to Nigeria as fast and smooth as sending a text. You don’t need to visit any office, just open the app, type in the details, and your money lands in Nigeria instantly. Simple as that.

Honestly? The game has changed. Gone are the days of long wait times and crazy charges. With Quick Collect, you send money from Canada to Nigeria in real time, and the receiver gets full value with no deductions. It’s instant, secure, and everything happens from your phone.

Zero Fees

That’s right—Quick Collect doesn’t charge you a single cent to send $1000 or even $20. Every transfer is fee-free, no matter the amount. You send $1000, and that exact amount gets converted at today’s rate.

As of today, Quick Collect’s rate is ₦1,145 per Canadian dollar.

That means:

$50 CAD = ₦57,250 in Nigeria.

And since there are no fees, your receiver gets the full ₦57,250

The easiest way is to download Quick Collect, set up your account in minutes, and send directly from your phone. No paperwork. No banking drama. Just fast transfers, great rates, and zero fees. It’s built for people who want a smarter way to send money home.

With today’s rate at ₦1,145 per dollar:

$200 CAD = ₦229,000.

That’s the full amount your receiver will get in their Nigerian bank account—no charges

Quick Collect is built with bank-grade security and end-to-end encryption. Every transaction is trackable, and your funds are protected. Thousands of users across Canada already trust Quick Collect for sending money to Nigeria fast and safely.

Truth is, both MoneyGram and Western Union can be expensive—especially if you’re sending larger amounts or using a debit or credit card. You might pay $10 to $30 in fees, and that’s before they apply their own exchange rates, which are usually lower than what you see online.

If you’re looking for a cheaper alternative, Quick Collect beats them both—hands down.

Zero fees, real-time exchange rates, and instant delivery. You get more Naira for your dollar, and your receiver gets the full amount. No games.

If you’re sending money from Canada to Nigeria, the cheapest option right now is Quick Collect.

Here’s why:

No transfer fees at all (even if you send just $10 or up to $1,000+).

Live exchange rate of ₦1,145 per dollar today.

No deductions on the receiving side.

Most traditional services will take a cut one way or the other—either upfront or hidden in the rate. Quick Collect doesn’t. That makes it not just cheap, but fair.

Let’s keep it real—most banks in Canada charge fees for international transfers. Some charge $15 to $30 per transaction. Others hide it inside the exchange rate. Even banks that say “no fee” often give you a bad rate.

Instead of using a bank, send your money through Quick Collect. It’s 100% fee-free, works faster than most banks, and your receiver gets more value in Naira.

With Quick Collect, you can send up to $10,000 CAD per transaction depending on your verification level. That’s more than enough for school fees, family support, or business needs.

And the best part?

Whether you send $50 or $5,000, the fee stays the same: ₦0.